A View from Outside the Echo Chamber

Essential Reading for Institutional Investment Plan Trustees

This newsletter is more narrowly focused than most, but several insights may still prove useful to both individual and institutional investors. The newsletter questions the merits of the philosophical foundation upon which nearly every institutional investment plan strategy now rests. It argues that investment strategies that were once considered unconventional (i.e., complex asset allocation, active management, and alternative asset classes), are now conventional. Moreover, it explains how existential financial incentives of investment consultants, OCIOs, and investment staff prevent trustees from discovering this reality. My hope is that this newsletter, and the recommended reading at the end, provides trustees with a much-needed, fresh perspective.

Entering and Exiting the Investment Consulting Profession

“Proper education is one long exercise in augmentation of high cognition so that our wisdom becomes strong enough to destroy wrong thinking maintained by resistance to change.”

—CHARLIE MUNGER, former vice chairman of Berkshire Hathaway

In 2009, I began my career as an investment consultant. Prior to entering the field, I read David Swensen’s book, Pioneering Portfolio Management. But like most readers, I overlooked the most important points. I arrogantly assumed that achieving Yale-like returns by skillfully selecting active managers and allocating to expensive alternative asset classes was possible for most institutional investment plans—or at least a meaningful portion of them. I believed all that was required was advice from a reasonably qualified investment staff, investment consulting firm, or OCIO. It was this belief that attracted me to investment consulting.

After several years, it become clear to me that reality was quite different than theory. Each quarterly meeting gave me a deeper appreciation for the fact that successful use of a “Yale strategy” was a rarity. For nearly all other investors incremental increases in portfolio complexity, active management, and alternative asset classes merely increased fees and were more likely to detract value rather than add it.

I expressed these concerns with increasing intensity, but colleagues almost universally dismissed them. They clung to unsubstantiated beliefs that, in aggregate, their recommendations added value to clients. At the same time, they proclaimed (and still proclaim) that their recommendations are immune to self-interest because of “no-conflicts-of-interest” policies. In reality, however, their advice suffers from a deep-seated conflict-of-interest rooted in the fact that the viability of their current business model depends on the implicit claim that proprietary asset allocation, active manager selection, and alternative asset class exposure add value. The mere contemplation that this assumption is false constitutes an existential threat that is easier to deny than to resolve.

Conventional Practices Impair Investment Plan Performance

“Once a majority of investors adopts a heretofore contrarian position, the minority view becomes the widely held perspective.”

—DAVID SWENSEN, late CIO of the Yale Investments Office

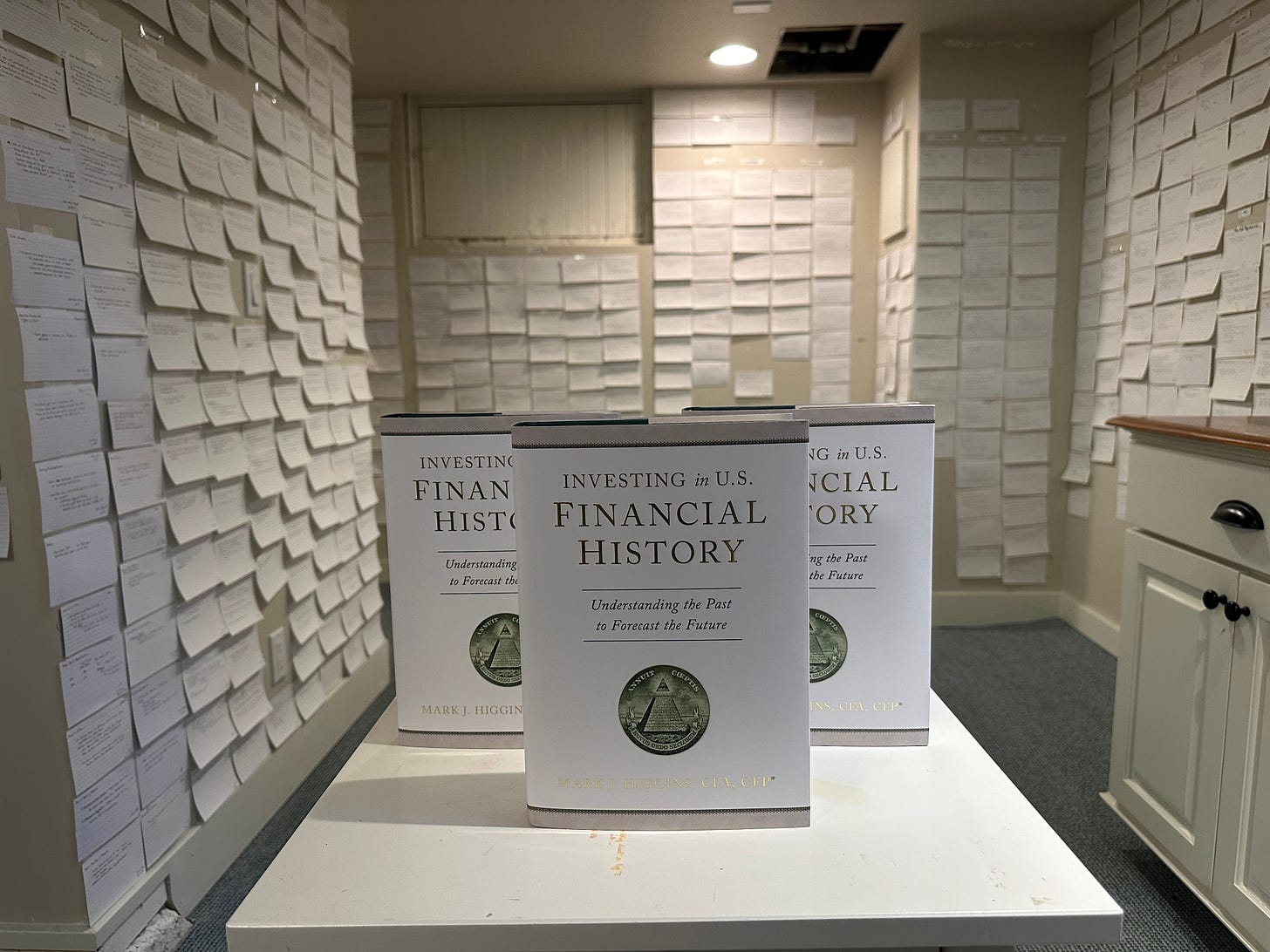

After leaving the investment consulting profession in March 2022, I spent two years completing my book, Investing in U.S. Financial History: Understanding the Past to Forecast the Future. The book recounts the major events that shaped the evolution of the U.S. financial system, economy, and securities markets from 1790 until 2023. The last fifty years of U.S. financial history were especially critical in the evolution of my personal, investment philosophy.

In 2024, nearly all trustees believe that that they can produce better results than a relatively simple portfolio consisting only of low-cost index funds. They believe they can do this by relying on complex asset allocation modeling, skillful active manager selection, and heavy alternative asset class exposure. In other words, they assume the same thing that I assumed fifteen years ago.

The problem with this belief is that a mountain of evidence reveals that the opposite is more likely to be true. The unconventional investing methodology pioneered by Yale University in 1985 is now conventional. In fact, the greatest irony today is that the most unconventional strategy is to rely heavily (if not exclusively) on low-cost index funds.

An Unconventional Education for Trustees

“People who are honest nowadays are accused of being mad.”

—HETTY GREEN, the Queen of Wall Street (1895)

One hundred and ninety years ago on this very day, Henrietta Howland “Hetty” Green was born in New Bedford, Massachusetts. Nobody fathomed that this young girl would rise to become one of the greatest investors in U.S. history. Even to this day, her story is rarely told correctly. She was mocked as a miser and derisively referred to as the “Witch of Wall Street” because her patience, thrift, modesty, and integrity were uncommon during the Gilded Age.

Over the past two years, I have documented many of the most important insights that explain why most institutional investment plans are destined for mediocre performance at best if they continue to embrace the status quo. This perspective is often dismissed and ridiculed, but I have yet to see anybody pose a compelling counterargument.

So, for trustees who are looking for an “unconventional” perspective, I encourage you to review the “Essential Reading” section of a site we assembled at IFA Institutional. It is a collection of seven articles that address key issues related to governance, investment strategy, and financial history. The perspectives are quite different from what trustees are accustomed to hearing. Regardless of whether you agree or disagree, it is always helpful to look at things in a new way.

ESSENTIAL READINGS FOR TRUSTEES

Governance

The Unexpected Legacy of a Prudent Man

Financial History magazine — Winter 2024

The Unspoken Conflict of Interest at the Heart of Investment Consulting

CFA Enterprising Investor — January 25, 2024

Active versus Passive Management

Denying the Odds: The History of Active Management in U.S. Securities Markets

Financial History magazine — Summer 2024

The Active Management Delusion: Respect the Wisdom of the Crowd

CFA Enterprising Investor — January 25, 2024

Alternative Asset Classes

A 45-Year Flood: The History of Alternative Asset Classes

Financial History magazine — Fall 2024

Vanguard’s Former OCIO Clients Must Stand Their Ground

CFA Enterprising Investor — July 3, 2024

Wall Street’s Latest Flood: Private Credit

CFA Enterprising Investor — October 24, 2024

Financial History

Investing in U.S. Financial History: Understanding the Past to Forecast the Future

Disclaimer: This is a personal newsletter. Any views or opinions expressed herein belong solely to the author and do not represent those of any people or organizations that the writer may or may not be associated with in a professional capacity, unless specifically stated. This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Past performance is no guarantee of future results. Investing involves risks, including possible loss of principal.