“Exigencies are to be expected to occur, in the affairs of nations, in which there will be a necessity for borrowing. That loans in times of public danger, especially from foreign war, are found an indispensable resource, even to the wealthiest of them…On the one hand, the necessity for borrowing in particular emergencies cannot be doubted, so on the other, it is equally evident, that to be able to borrow upon good terms, it is essential that the credit of a nation should be well established.”1

—ALEXANDER HAMILTON, first secretary of the U.S. Treasury

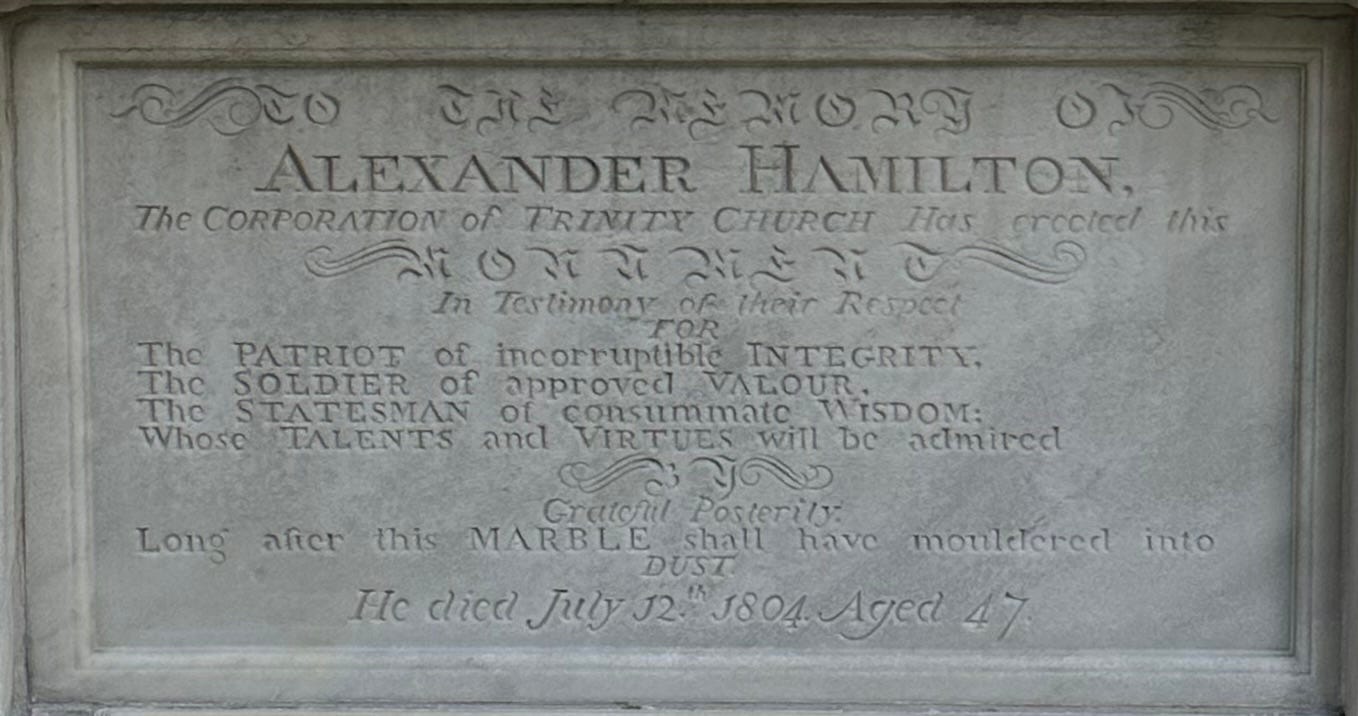

Alexander Hamilton is buried at Trinity Churchyard, which is only two blocks from the New York Stock Exchange.

July 12th marks the tragic passing of Alexander Hamilton. On this day in 1804, Hamilton died from a gunshot wound suffered in a duel with Aaron Burr. His gravestone honors his many contributions to the United States, the most notable of which were his brilliant financial reforms. In 1790, Hamilton nearly single-handedly resurrected the nation’s severely damaged credit by persuading a divided Congress to repay the nation’s war debts; enact modest tariff increases to fund repayment; and provide a firm footing for the U.S. financial system by establishing the nation’s first central bank.

Alexander Hamilton’s financial talents and virtues derived from his ability to gaze far into the future and anticipate challenges that the newly formed nation would likely encounter. Most importantly, he saw that preserving the nation’s ability to borrow on attractive terms would prove essential to its survival. Having barely defeated Great Britain in the Revolutionary War, Hamilton experienced first-hand how nations entering wars with limited credit face long odds of victory. The timing of future threats was unknowable, but Hamilton knew that they lurked on the horizon. Therefore, maintaining abundant debt capacity was essential, which is the principle that he articulated in the opening quote of this newsletter.2

The Secret to Rendering Public Credit Immortal

“Persuaded as the Secretary is, that the proper funding of the present debt, will render it a national blessing: Yet he is so far from acceding to the position, in the latitude in which it is sometimes laid down, that “public debts are public benefits,” a position inviting to prodigality, and liable to dangerous abuse,—that he ardently wishes to see it incorporated, as a fundamental maxim, in the system of public credit of the United States, that the creation of debt should always be accompanied with the means of extinguishment. This he regards as the true secret for rendering public credit immortal.”3

—ALEXANDER HAMILTON, first secretary of the U.S. Treasury

Hamilton’s foresight secured the nation’s survival on multiple occasions over the past 237 years. As he predicted, the U.S. encountered several public dangers, forcing Americans to draw upon their abundant debt capacity to fund effective responses. Notable examples included heavy borrowing during the War of 1812, Civil War, Great Depression, and two World Wars (Figure 1).

Figure 1: Total Gross U.S. Public Debt as a Percentage of GDP (1792-2032E)

Source: Mark J. Higgins, Investing in U.S. Financial History: Understanding the Past to Forecast the Future, (Austin: Greenleaf Book Group, 2024).

For most of its history, the U.S. also adhered to a second Hamiltonian financial principle. After each crisis subsided, the country gradually repaid its debts by running fiscal budget surpluses (Figure 2). This ensured that future generations could confront existential threats with adequate debt capacity. Hamilton considered this principle to be the key to “rendering public credit immortal.”

Figure 2: U.S. Fiscal Deficits and Surpluses (1792-2024)

Sources: Bureau of the Census, Historical Statistics of the United States, 1789-1945 (Washington, DC: U.S. Bureau of the Census, 1949).

Public Credit Reverts to Mere Mortality

“The position of the United States after World War II was entirely abnormal and unsustainable. We came through unscathed. Our industrial power actually strengthened, while our potential competitors were substantially destroyed and needed our help to rebuild themselves…It has been both natural and desirable for others to catch up to us from a very depressed state.”4

—PAUL A. VOLCKER, former chairman of the Federal Reserve Board

The U.S. emerged from World War II as the world’s wealthiest nation. Moreover, while the industrial infrastructures of European and Asian countries lay in ruins, the U.S. “Arsenal of Democracy” had fueled massive expansion of its industrial capacity and sharpened its technological edge. Americans enjoyed an extraordinary period of economic prosperity in the 1950s. Jobs were plentiful, poverty rates fell dramatically, inflation was low, and the middle class thrived. The combination of exceptional wealth and a vastly superior means to produce it explains why many Americans are nostalgic about life in the 1950s.3

The prosperity of the 1950s, however, gave way to chronic fiscal deficits in the 1960s. Politicians tolerated deficit spending, in part, because debt-to-GDP levels had substantially declined as a result of exceptional economic growth and reasonably balanced budgets in the immediate post-World War II years. Reverting back to Figure 1, you can see the dip in debt-to-GDP levels in the 1960s and 1970s.

The problem was that it was never realistic to expect such extreme economic dominance to last indefinitely. European and Asian countries steadily rebuilt their economies, and the wealth and competitive advantages of the U.S. narrowed relative to the rest of the world. Americans’ perceptions of their relative position, however, failed to keep pace. Decade after decade, this emboldened politicians to expand federal spending programs at an unaffordable rate. The most significant expansions involved entitlements, such as Social Security, Medicare, and Medicaid.5

To this day, few Americans have come to terms with the nation’s distorted perceptions of its own wealth. But the ruthless laws of math don’t lie. The data clearly reveal that the U.S. has spent far more than it can afford for more than half a century and has no plan to stop. Figure 3 presents Congressional Budget Office (CBO) data that shows past, current, and projected debt held by the public as a percent of GDP. This is precisely the situation that Alexander Hamilton feared when he advised Congress to establish a formal mechanism for extinguishing the debt after public dangers subside.

Figure 3: Past, Current, and Projected Total Debt Held by the Public to GDP (1962 - 2054)6

Making Unsustainable Deficits Even More Unsustainable

“If now the most classical, hardline president in fifty years [Ronald Reagan] accepts indefinite deferral of a balanced budget who will any longer be inhibited by fear of deficits?”7

—HERB STEIN, economist

After taking office in 1980, President Ronald Reagan announced a bold economic plan. The fiscal component included a combination of tax and spending cuts. The original plan was conceptually sound, but the final legislation deviated from the core principles. Proposed spending cuts were watered down to gain support from various constituencies in Congress, but tax cuts were left relatively intact. This allowed deficit spending to persist. The above quote expresses the frustration of a fiscal conservative regarding the inability of Reagan to end chronic deficit spending. In a rare example of unrelenting bipartisanship, the United States failed to shake this habit over the subsequent 45 years.

On July 4, 2025, President Donald Trump signed the One Big Beautiful Bill Act into law. According to the CBO, the bill is expected to increase the federal debt by another $3.2 trillion over the next 10 years, making an unsustainable situation even more unsustainable.8

The passage of the One Big Beautiful Bill Act is disappointing, but it is hardly an anomaly. For more than 200 years, politicians have rewarded key voting blocs with tax relief, while neglecting the unpleasant task of making painful spending cuts. Congress repeated this mistake in 2025, and it will likely keep repeating it unless a critical mass of Americans demands a return of fiscal responsibility.

Rendering Public Credit Immortal Again

In the 2020s, it appears most Americans remain mired in a deep state of denial. Those who downplay the impending consequences of nearly one hundred years of unsustainable spending can only resort to magical thinking to justify their positions. Some fantasize that perhaps the U.S. can outgrow its debt problems, much like it did in the late 1940s and 1950s. But those times were legitimately different. The industrial infrastructures of many global competitors were wastelands, and several tailwinds (e.g., exceptionally high productivity growth and steady labor force expansion) are now headwinds.9

Others venture deeper down the rabbit hole. The darkest recesses of Wonderland are occupied by proponents of Modern Monetary Theory (MMT), who make the ludicrous and frankly childish claim that the U.S. can run fiscal deficits indefinitely because the nation possesses the world’s dominant reserve currency. This argument may work for a few more years, but nations eventually lose their reserve currency privileges once the world stops viewing them as a risk worth taking. The Dutch suffered this fate in the late 1700s, and the British suffered it in the mid-1900s. The U.S. has no special immunity to this outcome.

The only realistic option for Americans is to re-embrace Hamiltonian financial principles and make painful sacrifices to rescue the public credit from its descent into mortality. This requires Americans to collectively relinquish claims that satisfy their present wants (as well as many needs) so that the nation’s children can afford the bare essentials. The consequences of voluntary action would be very painful but ultimately survivable. Inaction, on the other hand, may offer short-term relief, but when the day of reckoning arrives, the consequences would be far more severe. If current generations of Americans live to see such a day, they will discover that fate cares nothing for the magical thinking that currently shields them from feeling the shame of irresponsibility.

Hopefully, Americans find the will to resurrect Alexander Hamilton’s spirit, sacrifice in ways that many believe are beneath them, and restore the immortality of the public credit. Only then will current generations gain the right to claim they rose to the occasion and returned the financial resources that were unjustly pilfered from their progeny. Such an achievement would be worthy of praise from Alexander Hamilton. He dedicated and ultimately sacrificed his life to create a rock-solid financial foundation upon which the United States of America now rests. By restoring the immortality of public credit, perhaps we will allow his spirit to rest in peace once again.

Disclaimer: This is a personal newsletter. Any views or opinions expressed herein belong solely to the author and do not represent those of any people or organizations that the writer may or may not be associated with in a professional capacity, unless specifically stated. This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are not guarantees investment strategies will be successful. Past performance is no guarantee of future results. Investing involves risks, including possible loss of principal.

Alexander Hamilton, Report Relative to a Provision for the Support of Public Credit. January 9, 1790). https://founders.archives.gov/documents/Hamilton/01-06-02-0076-0002-0001

For those interested in learning more about Alexander Hamilton’s financial programs and insights, I encourage you to read the first two chapters of Investing in U.S. Financial History. These chapters are accessible for free here.

Hamilton, Report Relative to a Provision for the Support of Public Credit.

Paul Volcker and Toyoo Gyohten, Changing Fortunes: The World’s Money and the Threat to American Leadership (New York: Random House, 1992), XV.

Higgins, Mark J., “Short-Term Gains and Long-Term Pain: The History of US Entitlements.” Financial History (Spring 2025).

Congressional Budget Office. https://www.cbo.gov/data/budget-economic-data#1

Steven Hayward, The Age of Reagan: The Fall of the Old Liberal Order: 1964–1980 (New York: Crown Forum, 2009).

Congressional Budget Office. https://www.cbo.gov/publication/61534

Robert Gordon, The Rise and Fall of American Growth (Princeton: Princeton University Press, 2016).

Amen, Mark!

The good news is that even modest adjustments to benefit spending today can result in large gains in solvency over time.

Most notably, an employer-based health insurance system is monstrously inefficient, ineffective and unjust, hence our spending is almost twice that of other developed nations with among the worst outcomes in terms of health and longevity.

And, our defense spending remains unsustainable and needs to be strategically re-imagined to suit the geopolitical circumstances of our times at meaningfully reduced levels.

Equally importantly, the revenue side of the equation cannot be ignored. Political leaders in the US have indulged our citizenry with unrealistically low levels of paid taxation given the socio-economic needs of the nation in modern times.

A greatly simplified tax code that actually results in all people contributing and people of extreme means paying a larger share than currently is essential.

All these may be seemingly 'undesirable' remedies and components of a restoration of our collective fiscal health; but, if we fail to take them during times of relative peace and prosperity, future generations will be saddled with an intractable challenge that could well result in civil unrest and a fracturing of our national polity.