Asset Bubble Red Flags and the Rise of AI

Watching for the Subtle Signs of Insanity

On May 18, 2023, Roundhill Investments launched the first ETF focused exclusively on “generative AI” investments. The fund received relatively light media coverage, but the announcement was noteworthy from a historical perspective. The proliferation of trendy sector funds is often a warning sign of asset bubbles, and it seems likely that similar fund launches are forthcoming.

Building on this observation, the current issue of Investing in Financial History highlights three red flags that often accompany the rise of asset bubbles. It is too early to declare that AI will inflate into the next bubble, but it is worth being on the lookout for these indicators.

1. Unwarranted Attention to Untested Investment Gurus

Early investors in asset bubbles often benefit from enormous financial windfalls. The problem, however, is that their success is often a function of being in the right place at the right time, rather than the sudden expression of a previously dormant investing genius. Nevertheless, journalists often prematurely promote such individuals as the next market gurus who can guide investors through a new era. This encourages investors to follow them blindly into a bubble. A few examples, along with their infamous quotes, are included below.

Famous Last Words from Past Asset Bubbles

In the 2020s, Cathie Wood is perhaps the best example of this phenomenon. In 2020, Wood’s ARK Innovation Fund rose by 147% versus only a 15% rise for the S&P 500 Index. But the fund’s exceptional performance was driven mostly by feverish speculation made possible by massive fiscal and monetary stimulus. The folly of her stock selection now speaks for itself. Once the excess liquidity evaporated, so did ARK’s returns, and the losses have now more than exceeded the fleeting gains. Since January 1, 2020, the growth of $1 invested in the S&P 500 would be $1.29, while a similar investment in the ARK Innovation Fund would be worth only $0.80. (see figure below).

Cathie Wood is not the first nor will she be the last example of this phenomenon. If the AI boom persists, new market gurus will almost certainly emerge, and investors should be wary of their advice.

2. Launch of Specialty Funds

“Separating the impact of the wind at the back (or the wind in the face) contributed by market forces from the influence of the skill (or lack thereof) exhibited in security selection proves incredibly difficult, particularly in instances where the manager frequently adjusts market exposure.”1

David Swensen, Late CIO of the Yale Investments Office

Portfolio managers of actively managed funds are often more keenly attuned to shifts in speculative winds rather than the long-term prospects of the stocks in their portfolios. It is unsurprising, therefore, that asset bubbles are often accompanied by a proliferation of specialty funds that invest in anything associated with the bubble. Past examples include: aggressive growth “go go” funds (1960s), internet funds (1990s), and crypto funds (2010s and 2020s). It is too early to predict whether the AI craze will devolve into a similar frenzy, but if the first “generative AI” fund inspires a rush of copycats, it would constitute a big red flag.

3. Emergence of New Market Indices

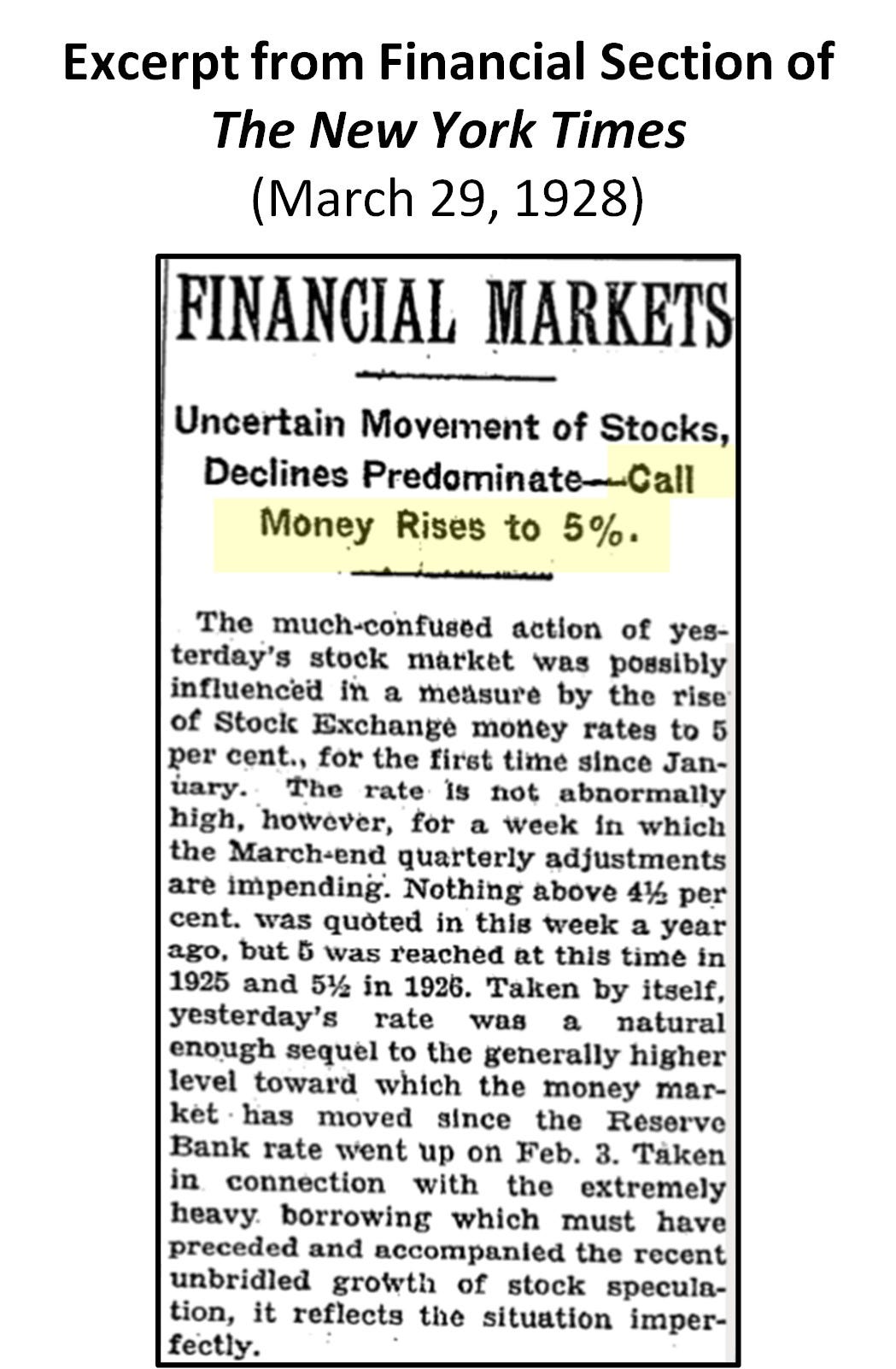

The final red flag is the launch of new indexes that report the returns of assets linked to an asset bubble. This red flag often appears relatively late in the game. There are a few notable examples from history. First, in March 1928, The New York Times added a call loan indicator to its market report because the price of call loans had become inseparable from the rise of stock prices (see image below from the March 29, 1928 issue of The New York Times). Second, in February 2000, The New York Times added the tech-heavy Nasdaq Composite Index to its list of four major market indicators, which included the Dow Jones Industrial Index, the Thirty-Year Treasury Yield, the Euro, and the U.S. dollar. Finally, in February 2021, CNBC added a new link to cryptocurrency prices to the top of its home page. The link sat beside pre-existing links to U.S. stocks, European stocks, Asian stocks, bonds, oil, gold, and foreign exchange. As of today, there are no such links on CNBC for “AI stocks,” but it will be interesting to see if one appears.

Differentiating Technology Advancements from Investment Opportunities

“In 1929 alone, the public poured $400,000,000 into aviation stocks. Any company with the word “air” or “aviation” in its title could sell its stocks. Even the price of the stock of the Seaboard Air Line—an East Coast railroad—spurted suddenly when some members of the investing public decided that with such a name the road must be truly an airline.”2

Walter S. Ross, Author

Wise investors evaluate investments thoroughly before making purchases. Regardless of market conditions, few investors adhere to such discipline, but the number becomes even smaller in the presence of an asset bubble. The maturation of AI over the next decade may very well bring monumental advancements to society. The challenge, however, is that there will be far more companies that claim to contribute to these advancements than those that actually do.

Now is the time to be on guard. Early warning signs are that AI investments are vulnerable to bubble conditions. For those who believe they can jump in and jump out, history suggests that the timing of both are much more difficult than most people believe. As always, the best approach for almost all investors is to understand your investment objectives, design a stable allocation to meet those objectives, rebalance regularly, and rely primarily (if not exclusively) on low cost index funds.

David Swensen, Unconventional Success. (New York: Free Press, 2005).

Walter S. Ross, The Last Hero: Charles A. Lindbergh. (New York: Harper & Row Publishers, 1942).